Blog

Choosing the Right Forex Broker for Automated Trading

Automated trading is easier than ever for traders of all levels and grows in popularity yearly. Selecting the right forex broker is crucial to engage in successful automated trading. Nearly all brokers offer access to automated trading, but not all provide efficient services. It is essential to consider specific factors when choosing a broker for automated trading, which are explained below.

Trading Platform Compatibility

The trading platform plays a vital role in automated trading. Ensure that the forex broker you choose offers a trading platform compatible with your chosen automated trading software or programming language. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely supported by various automated trading systems and offer a range of features, including expert advisors (EAs) and custom indicators. Advanced traders will seek brokers who can accept orders directly from an API connection. Verify that the broker supports the necessary tools and functionalities to execute your automated trading strategies effectively.

Low Latency and Fast Execution

Automated trading systems often rely on the timely execution of trades, and even a slight delay can significantly impact the strategy's performance. Look for forex brokers that offer low latency connections and fast execution speeds. This ensures that your trades are executed promptly and at the desired price, minimizing slippage and maximizing the efficiency of your automated trading system. Brokers who offer a Virtual Private Server (VPS) service where your trading system is executed on another computer close to the broker can be attractive in many situations.

Reliable and Stable Infrastructure

For automated trading to be successful, the broker's infrastructure must be robust and stable. Technical glitches, downtime, or server disruptions can disrupt the execution of automated trades and potentially lead to financial losses. Choose a forex broker with a reputation for reliable infrastructure, redundant servers, and a stable trading environment. Look for brokers that invest in advanced technology and have a track record of providing uninterrupted trading services. While many brokers promise high-level infrastructure, the best way to test a broker is to open an account and try demo trading or with a small live account to test performance.

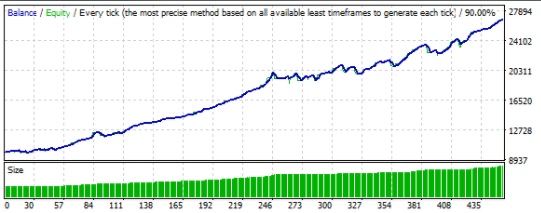

Backtesting and Strategy Development Tools

A good forex broker for automated trading should offer comprehensive backtesting and strategy development tools. Backtesting allows you to evaluate the performance of your automated trading strategy using historical data. It helps you identify potential flaws and refine your strategy before deploying it in live trading. One of the most popular tools is MT4 and MT5, which many brokers offer. Brokers who provide materials to educate on backtesting are advantageous for beginner traders.

Pricing and Fees

Consider the pricing structure and fees associated with the forex broker's services. Brokers may have varying fee structures, including spreads, commissions, overnight financing charges, and withdrawal fees. Compare the costs associated with your automated trading strategy and evaluate if the broker's pricing aligns with your trading needs. Many brokers will offer narrow spreads on the most popular markets like USDJPY but widen spreads on other markets. Check the price spread on the markets you trade and how that spread changes over time.

Market Access and Liquidity

The availability of a wide range of currency pairs and access to deep liquidity is essential for automated trading. Choose a forex broker that provides access to major currency pairs and exotic and minor pairs. Additionally, verify that the broker has established relationships with reputable liquidity providers to ensure efficient trade execution, especially during periods of high market volatility.

Risk Management Tools

Effective risk management is crucial in automated trading. Look for forex brokers that offer risk management tools and features that align with your trading strategy. These tools may auto-exit all your positions should your account get close to zero, protecting you from unexpected losses. Strong risk management tools can ensure the longevity of your automated trading system.

Regulation and Security

Choosing a regulated forex broker is vital to ensure the security of your funds and protect your interests as a trader. Regulated brokers are subject to stringent financial regulations and oversight, providing an additional layer of protection for your trading capital. Verify that the broker is licensed and regulated by reputable financial authorities in their respective jurisdictions. It's also essential to assess the broker's reputation and track record to ensure they have a history of adhering to regulatory guidelines and maintaining client fund security.

Customer Support

Reliable customer support is crucial when it comes to automated trading. Technical issues, software glitches, or connectivity problems can occur, and timely assistance is essential to resolve these issues. Choose a forex broker that offers responsive and knowledgeable customer support. Test their customer support channels before opening an account to ensure prompt and effective assistance whenever needed.

Choosing the right forex broker for automated trading is crucial for the success of your trading strategies. Consider factors such as platform compatibility, low latency execution, reliable infrastructure, backtesting tools, market access, risk management features, regulation, customer support, and pricing when deciding. Conduct thorough research, read reviews, and consider the specific requirements of your automated trading system. By selecting a reputable and suitable forex broker, you can optimize the performance of your automated trading strategies and enhance your overall trading experience.